Tag: Bankruptcy. Considerations

Stopping the Bills with the Automatic Stay of Bankruptcy

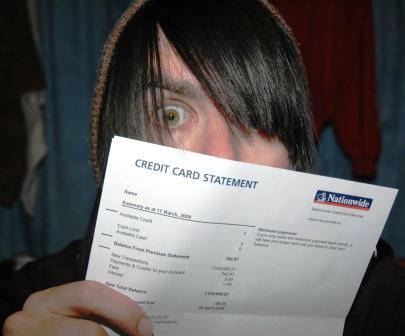

Stopping the bills. They pile up. You want to pay them. You think about how to juggle finances to stop the bills and collection notices. Some of the bill collectors or credit card companies behind them may even have started actions in small claims or other courts. The automatic stay […]

Court Papers – Always Answer Complaints and Other Legal Documents

Court papers, sometimes served by a sheriff or process server, other times arriving by mail, should never be ignored. Failing to respond will result in a default judgment. Always answer a summons within the time limit. When you are served with a law suit, the papers will tell you the […]

Bankruptcy Exemptions: Why You Need Them

Like an iron gate protecting an entrance, bankruptcy exemptions protect a debtor’s property against loss in bankruptcy. Theory of Bankruptcy Exemptions In the old days when a person filed bankruptcy, the story goes, their property was taken and sold or ‘liquidated’, the proceeds then divided among creditors. Any remaining debt […]

Debt Collectors and Bankruptcy Violations

Debt collectors must stop after a bankruptcy filing or they commit one of several bankruptcy violations. It doesn’t matter whether it’s a chapter 7, chapter 13 or other chapter. The filing of a bankruptcy creates what is called an automatic stay. Collection stops because the U.S. Bankruptcy Code imposes the automatic stay with […]

BANKRUPTCY: INCLUDE ALL ASSETS INCOME AND DEBT

People sometimes talk about “putting things into” a bankruptcy, or “not putting something into” their bankruptcy. In reality, bankruptcy law requires full complete truthful disclosure of all assets, income and debt. Often, various issues can be addressed in a beneficial manner as long as there is full disclosure. But, when […]

PERSONAL INJURY: Liability – No “Guilt” or “Innocence”

“Guilt” and “Innocence” exist in criminal law, not civil negligence law. Concepts of guilt or innocence refer only to criminal matters, where an individual faces prosecution by the government at some level. Even in an accident caused, allegedly, by a person running a red light, the light runner is not […]

Charge Off: What is it? Do I Still Have to Pay Charged Off Debt?

A “Charge off” is an accounting device used by creditors. Generally, if a debt has not been paid for 180 days or more, the original creditor will write off your debt, removing it from their books. It does not mean that the debt no longer exists or that you no […]

Too Broke To Go Bankrupt

I didn’t make up the title. Those words headline a CNN Money Magazine article on May 7, 2012. Quoted sources explain how the cost of filing bankruptcy steadily increased after passage of bankruptcy “reform” by the U.S. Congress in 2005. The so-called “Bankruptcy Abuse Prevention and Consumer Protection Act”, or […]

Discharge of Student Loans in Bankruptcy: Exception to Rule

Discharging student loans in bankruptcy occurs only as an exception to the rule. Chapter 7 bankruptcy discharges garden variety unsecured debt, largely credit cards. But, student loans are different. To discharge student loans there must be proof that payment imposes an undue hardship as defined in bankruptcy law. Many courts […]

Bankruptcy Basics: Chapter 7, Chapter 13

There are two basic types of consumer bankruptcy, Chapter 7 and Chapter 13. Chapter 7 cancels or “discharges” many types of debt. Most credit card, medical, and other unsecured debts are discharged, as are most court judgments and loans. Many filers find all of their debts discharged. Debts not discharged […]